HEALTH SHARE PLANS

A Timely Alternative for Employers and Individuals

Health share programs bring together like-minded individuals who share medical expenses, offering a cost-effective alternative to traditional insurance.

Health Share Programs: Poised for Continued Growth

Over the past two decades, Health Share programs have steadily expanded, and a major shift is anticipated in the coming years. As rising insurance costs continue to strain both businesses and employees, more companies are exploring cost-effective alternatives to traditional health insurance. In response, employers and employees alike are turning to Health Share Plans.

Memberly is committed to finding cost-effective healthcare solutions, and while Health Share programs may not be as comprehensive as traditional insurance, they offer several key benefits for both employers and individuals:

Lower Cost

Health share plans start at $82/mo.

Cost up to 90% less than traditional health Insurance.

Flexibility

Works for Individuals as well as employers.

Can be paired with other benefits to fortify the program.

Essential Care

Offers coverage for hospital events.

Buy-ups for preventive services, virtual care, and pharmacy.

No Mandates

Not subject to ACA and other regulations.

Employees can start any time of year – not subject to open enrollment periods.

Why Health Share?

Affordable. Flexible. Member-Focused.

Health Share Programs provide an alternative to traditional insurance by allowing members to share medical expenses through a structured cost-sharing model. Unlike traditional employer-sponsored health plans, these programs offer lower costs, greater flexibility, and streamlined administration—ideal for businesses looking to provide healthcare benefits without breaking the bank

Why Employers are Choosing Health Share Programs

Sustainability Is Key for Employers Overrun by Health Insurance Premiums

Lower Costs

Enjoy significantly reduced monthly costs compared to traditional insurance.

Flexible Options

Tailored plans that fit your workforce, whether full-time, part-time, or contract employees.

Nationwide Access

Employees can see any provider, often with negotiated discounts and fair pricing models.

No Network Restrictions

Unlike traditional PPO or HMO plans, members have freedom of choice when selecting doctors and facilities.

Simple Administration

Less paperwork, no renewal negotiations, and hassle-free enrollment.

Enhancing Health Share Plans with Strategic Benefit Pairings

Lump-Sum Payouts Provide Immediate Financial Relief

Health Share plans can be combined with additional benefits to help employees cover gaps in coverage and provide financial support when illnesses or accidents occur. Memberly assists in identifying and structuring the right benefit pairings to enhance coverage, ensure financial protection, and improve access to care.

Hospital Indemnity

Lump-Sum Paid to Employee*

Pairing a Hospital Indemnity policy with a Health Share plan provides a lump-sum payout when an employee is hospitalized.

In a traditional health plan, hospitalization costs typically apply to the deductible, but with this pairing, employees receive direct financial assistance to offset those expenses.

For example, if an employee is hospitalized due to an accident or illness, they would receive a $5,000 lump-sum payout on top of their Health Share coverage.

Critical Illness

Lump-Sum Paid to Employee*

Pairing a Critical Illness policy with a Health Share plan provides a lump-sum payout when an employee is diagnosed with cancer or a heart attack.

Unlike traditional health health plans that must reach a deductible before coverage applies, this pairing ensures employees receive a direct payout to cover medical costs, lost wages, or other expenses.

For example, an employee diagnosed with a covered illness would receive a $5,000 payout in addition to their Health Share benefits.

Accident

Lump-Sum Paid to Employee*

Pairing an Accident Policy with a Health Share plan provides a lump-sum payout when an employee experiences a covered injury, such as a fracture or concussion.

Unlike traditional health plans that require meeting a deductible first, this pairing ensures employees receive immediate financial support for medical bills, lost wages, or other expenses.

For example, an employee injured in an accident would receive a $5,000 payout in addition to their Health Share benefits.

*Benefit Face Amount Available: $5,000 to $100,000

Expand the Value of Health Share Plans with Preventive Care & Pharmacy Buy-Ups

Customized Coverage for Greater Healthcare Access

Employers can expand their Health Share program by offering buy-ups for preventive care and pharmacy benefits. These options provide members with greater access to essential services, including routine check-ups, vaccinations, prescription medications, and chronic condition management.

Preventive Sharing

Buy-up

$20 /month

Pharmacy Sharing

Buy-up

$10 /month

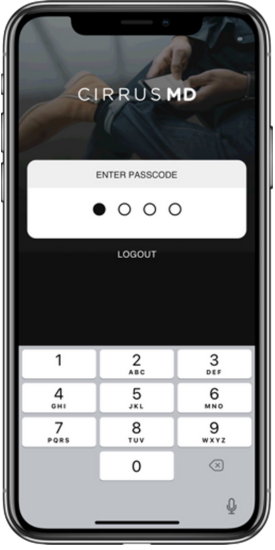

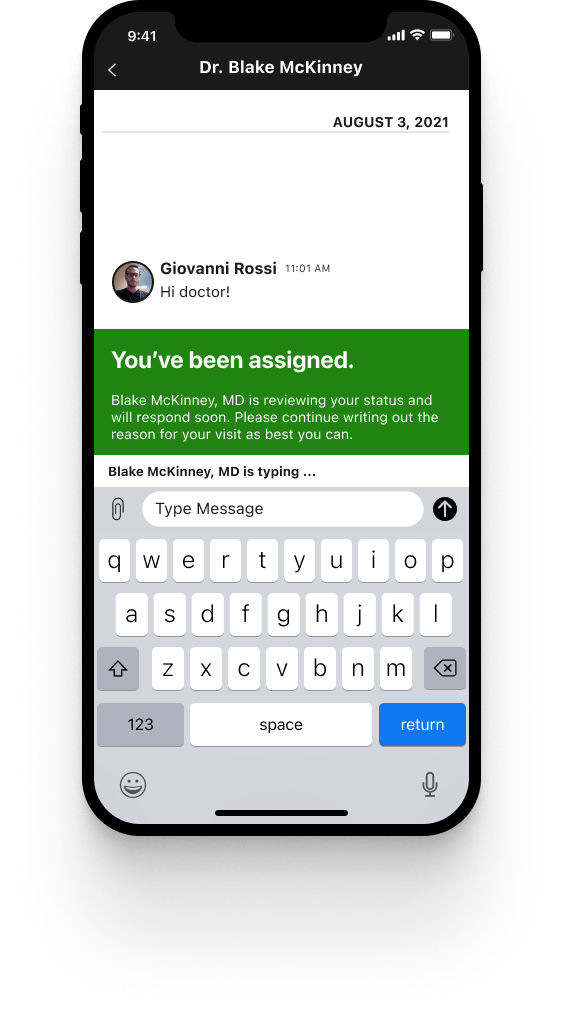

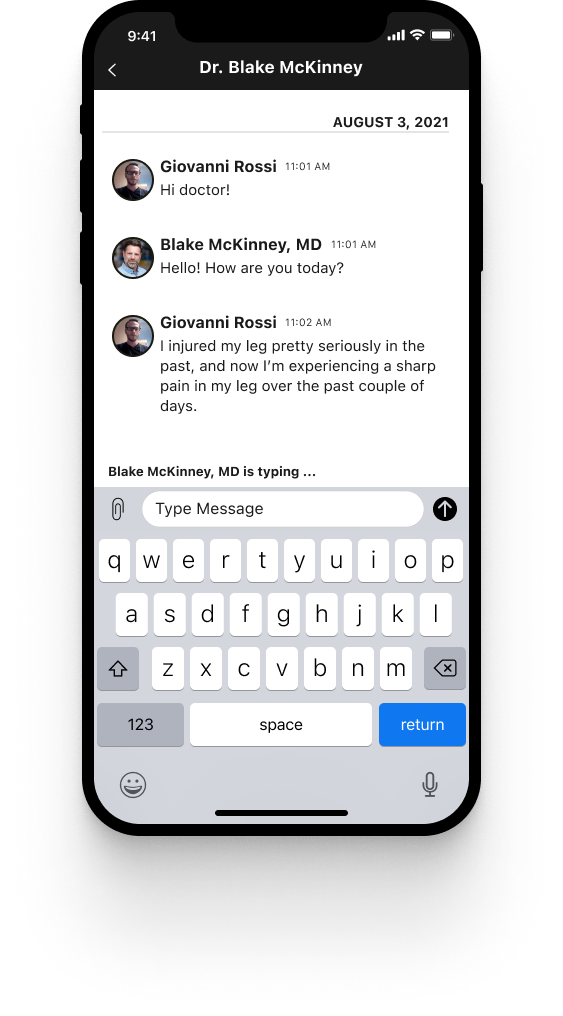

CirrusMD Virtual Care Included in Every Plan

Memberly includes CirrusMD virtual care at no cost in every health share plan, ensuring employees have immediate access to a licensed physician in their state within 60 seconds. With no appointments, wait times, or additional fees—plus never a bill—employees can get the care they need anytime, anywhere. Whether it’s a minor illness, prescription refill, or medical advice, CirrusMD provides a seamless, convenient healthcare experience, empowering employees with on-demand support when they need it most.

Chronic Condition Management and Medication Support

Cholesterol Management – Work with CirrusMD doctors to monitor cholesterol, adjust medications, and receive lifestyle guidance to reduce heart disease risk.

Diabetes Support – CirrusMD doctors help patients control blood sugar levels, adjust medications, and provide nutrition advice.

Asthma Care – Get personalized treatment plans, prescription refills, and symptom management through CirrusMD.

Chronic Condition Management and Medication Support

Cholesterol Management – Work with CirrusMD doctors to monitor cholesterol, adjust medications, and receive lifestyle guidance to reduce heart disease risk.

Diabetes Support – CirrusMD doctors help patients control blood sugar levels, adjust medications, and provide nutrition advice.

Asthma Care – Get personalized treatment plans, prescription refills, and symptom management through CirrusMD.

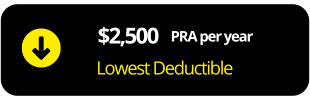

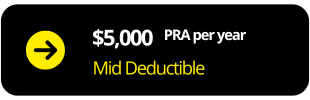

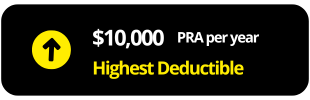

How much less is Health Share?

Health Share membership rates are determined by the age of the oldest household member and the selected membership type.

EMPLOYEE

18 -28 years old

$166

30 – 49 years old

$194

50 – 64 years Old

$284

EMPLOYEE & SPOUSE

18 -28 years old

$331

30 – 49 years old

$357

50 – 64 years Old

$515

Employee & CHILD

18 -28 years old

$331

30 – 49 years old

$357

50 – 64 years Old

$515

FAMILY

18 -28 years old

$508

30 – 49 years old

$5518

50 – 64 years Old

$740

EMPLOYEE

18 -28 years old

$109

30 – 49 years old

$130

50 – 64 years Old

$229

EMPLOYEE & SPOUSE

18 -28 years old

$218

30 – 49 years old

$260

50 – 64 years Old

$406

Employee & CHILD

18 -28 years old

$218

30 – 49 years old

$260

50 – 64 years Old

$406

FAMILY

18 -28 years old

$383

30 – 49 years old

$394

50 – 64 years Old

$562

EMPLOYEE

18 -28 years old

$82

30 – 49 years old

$108

50 – 64 years Old

$160

EMPLOYEE & SPOUSE

18 -28 years old

$160

30 – 49 years old

$216

50 – 64 years Old

$314

Employee & CHILD

18 -28 years old

$160

30 – 49 years old

$216

50 – 64 years Old

$514

FAMILY

18 -28 years old

$268

30 – 49 years old

$324

50 – 64 years Old

$464

Get Started with Health Share Today

Memberly helps employers navigate the best Health Share options for their workforce. Whether you’re looking for full coverage, supplemental options, or a completely new approach, we’ll find the best fit for your business.

Break Free from the High-Cost Cycle of Traditional Health Insurance – Explore the Benefits of Health Share!

If you’re already in a health plan but want to align your healthcare costs with financial reality, now is the perfect time to explore your options. Memberly partners with multiple Health Share programs and can recommend the best fit for your needs, ensuring maximum value. Simply provide an employee census and the plan options you’d like to offer, and we’ll guide you through the process. Additionally, if you provide your current plan carrier invoices and renewal notices, we will conduct a savings analysis to help you make an informed decision.

Recent Carrier Invoice

Renewal Carrier Notice

Employee Census with dependents

Current Plan SBCs

Expanded Coverage with Preventive Care, Pharmacy, and Free Virtual Care

Enhance your Health Share plan with optional buy-ups for preventive care and pharmacy benefits. Plus, every Memberly plan includes CirrusMD virtual care at no cost, providing employees with 24/7 access to licensed physicians within 60 seconds.

Preventive Buy-up

Pharmacy Buy-up

Free Virtual Care

Boost Employee Protection with Direct Payouts from Add-on Policies

Pairing Health Share plans with Hospital Indemnity, Critical Illness, or Accident Insurance ensures employees receive direct cash payouts during medical events. These policies provide financial relief by covering hospitalization, serious diagnoses, or accidental injuries helping employees manage out-of-pocket costs, lost wages, and other expenses. This added layer of protection enhances financial security and peace of mind.

Hospital Indemnity

Critical Illness

Accident

Common Questions

Learn More About Health Share Plans

Basics of Health Share Plans

A health sharing plan is an alternative healthcare arrangement where members share medical expenses with one another instead of paying premiums to a traditional insurance company. Members contribute a fixed monthly share, and in turn, receive help covering eligible medical expenses.

The PRA is the per-household, per-year amount a member must pay out-of-pocket before their eligible bills are shared by other health share members. Each member may be required to meet a PRA per incident or per year, depending on the plan.

Many health sharing plans exclude pre-existing conditions for a specified period after enrollment. This waiting period can range from one to several years. Some plans may offer partial coverage after the waiting period or under certain conditions.

Typically, health sharing plans do not cover preventive care in the same way traditional insurance does. However, some plans may offer certain preventive or wellness services, such as screenings or vaccinations, either as part of membership or at discounted rates.

Health sharing plans are not regulated by the Affordable Care Act (ACA) and do not meet its requirements for minimum essential coverage. They often come with lower monthly contributions but higher out-of-pocket costs and fewer protections. Traditional insurance must cover essential health benefits, pre-existing conditions, and preventive services under the ACA.

Most health sharing plans help with eligible expenses such as hospitalization, surgery, doctor visits, emergency care, and prescription medications. Coverage details vary by plan, and elective or cosmetic procedures are usually not included.

Most health sharing plans do not have provider networks like traditional insurance. Members often have the freedom to choose their own providers, though some plans may have guidelines or require pre-approval for large expenses.

Emergency services are typically eligible for sharing, but requirements such as pre-approval or responsibility for the PRA may apply. Plan rules vary, so it's important to understand the process before an emergency occurs.

Yes. Common exclusions include pre-existing conditions during the waiting period, elective procedures, and high-risk treatments. Some plans may also have limits on certain services or cost-sharing caps.

Health Share Paired with MEC

Yes. When employers bundle a health share program with MEC, employees gain access to a national network with pre-negotiated, discounted rates for services.

No. MEC plans typically do not have deductibles, allowing employees to access covered services immediately.

Yes. MEC plans include ACA-compliant preventive care such as checkups, vaccinations, and screenings at no cost when using in-network providers.

The employer. Claims for MEC-covered services are paid by the employer, helping employees avoid surprise medical bills for routine care.

Health share programs generally help with larger, unexpected medical expenses like hospital stays, surgeries, and emergency care, while MEC handles routine preventive services.

No. Health share programs are not insurance. However, when bundled with MEC, the combination offers preventive care and access to cost-sharing for larger medical events.

Yes, but using in-network providers is encouraged to maximize benefits and minimize out-of-pocket costs. Out-of-network care may be covered at reduced levels.

Most bundles include a discount prescription program. Some MEC plans include basic drug coverage, though high-cost prescriptions may not be fully covered.

Employees receive a member guide at enrollment with coverage details, provider information, and instructions for accessing care. Support teams are available for additional help.

Yes. Offering a MEC plan satisfies the ACA employer mandate and helps avoid penalties. The health share program adds an additional layer of protection.

Pairing Hospitalization, Critical Illness, and Accident Insurance with Health Share

Bundling adds financial protection for events not fully covered by the health share. These plans pay out cash benefits directly to employees during major medical events.

Accident insurance pays a lump sum benefit for injuries like sprains, fractures, or burns. This cash can be used for medical bills or any personal expense.

Critical illness insurance provides a lump-sum payment when diagnosed with conditions like cancer, heart attack, or stroke—helping cover costs while health share handles the core medical bills.

Hospital indemnity insurance pays a daily cash benefit for hospital stays or surgeries. These funds can be used for out-of-pocket costs or lost income.

Yes. These are regulated insurance products that complement health share programs by adding extra layers of protection.

Yes. Payouts go directly to the employee and can be used for medical bills, rent, childcare, or other expenses.

Often, yes. These bundles typically cost less than traditional group insurance while offering strong financial protection for high-cost events.

Unlike traditional plans, these insurance policies pay benefits immediately—no deductible required—providing quick financial relief for qualifying events.

Memberly partners with leading health share and insurance providers to tailor each bundle to the group’s needs, budget, and goals—ensuring maximum value and compliance.

This approach is ideal for small to mid-sized businesses, part-time or hourly workers, and cost-conscious employers seeking meaningful coverage without the cost of major medical insurance.